Transform Onboarding

from a Cost Center to a Revenue Driver

Streamline onboarding across all channels with a single, unified platform enabling banks, insurance, and NBFCs

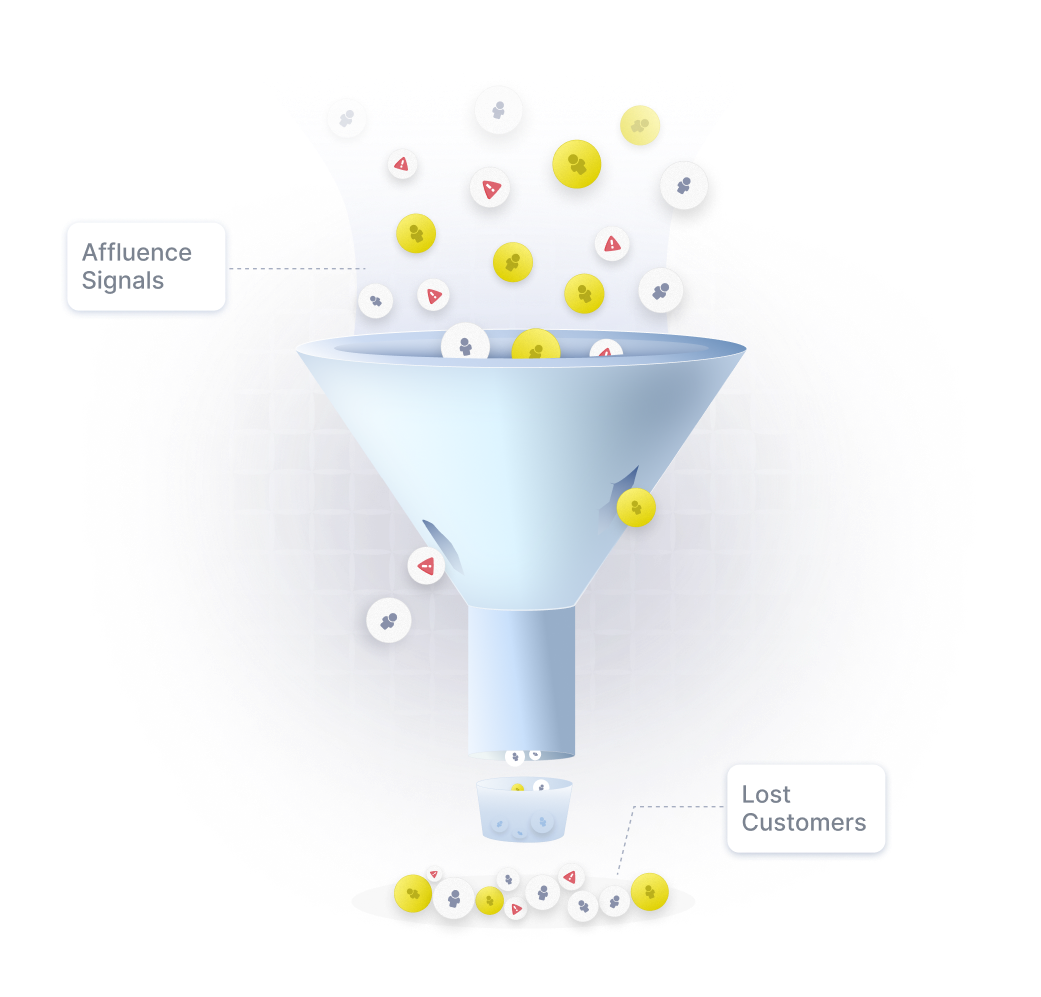

Onboarding journeys are Broken for Organizations Everywhere

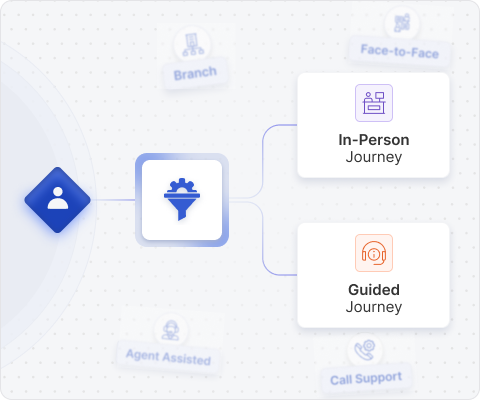

Across industries, organizations use isolated onboarding channels and disjointed workflows, resulting in inconsistent, frustrating experiences that drive customers and other stakeholders away.

Lack of affluence and risk signals from journey data and alt data

Risk-affluence segments aren't mapped to tailored journeys, resulting in generic flows for everyone

Cross-channel continuity is broken - users can't resume journeys from where they left off

Meet OnboardIQ: Unified Onboarding Across Branch, Assisted & Digital

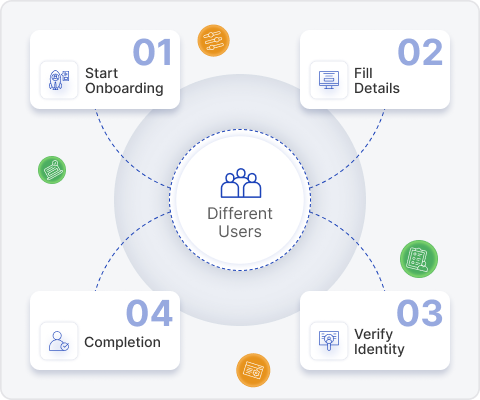

OnboardIQ is a unified, intelligence-led platform that enables your teams and channels to deliver intelligent, immersive, and trustworthy conversations across every onboarding journey.

Seamless Onboarding, Zero Compromise

Streamline customer and employee verification while staying secure, compliant, and conversion-focused

KYC API Suite

Suite of APIs for identification and verification, designed to integrate with your workflows

Video Solutions

Accelerate customer onboarding with IDfy’s Video KYC. Seamless, compliant, and designed to help you convert more customers faster

Background Verifications

Step into the future of employee onboarding – AI-powered, fraud-resistant, and privacy-first. Stay ahead of evolving threats

IDfy 360

Launch onboarding in just 1 day with IDfy360 – no-code, end-to-end, and designed to boost conversions and revenue.

Reimagine Onboarding Across Different Products and Journeys.

Banking

Liabilities Onboarding journeys for Current Accounts and Savings Accounts

FMCG

Retailer/Distributor Onboarding, Vendor Monitoring, Frontline Employee Authentication

NBFC

Pre-LOS Solicitation Engine for Go / No-Go signals, Loan Onboarding journeys for PL, Gold Loans, and CD Loans

Insurance

Direct Sales Enablement, Agent and Customer Onboarding, Pre-Issuance Verification, Underwriting Cross & Up-Sell, Hospital Due Diligence, Vehicle & Driver Due Diligence

ECommerce/Logistics

Seller Onboarding, Vendor Monitoring, Driver Partner Authentications

Payments

Onboarding, Enhanced Due Diligence, Activation, Cross & Up-Sell, Periodic KYC Updation

Customers

Onboarding, Underwriting, Activation & Engagement, Monitoring

Smarter Signals. Safer Growth. Stronger Compliance.

Uncover affluence and detect risk early. Drive smarter growth from day one.

Equip Frontline for Impact

Empower frontline teams with real-time wealth and risk insights to maximize customer lifetime value.

Strengthen Portfolio Quality

Use affluence indicators and early risk flags to match customers with the right products—balancing growth with portfolio quality

Unify Customer Insights

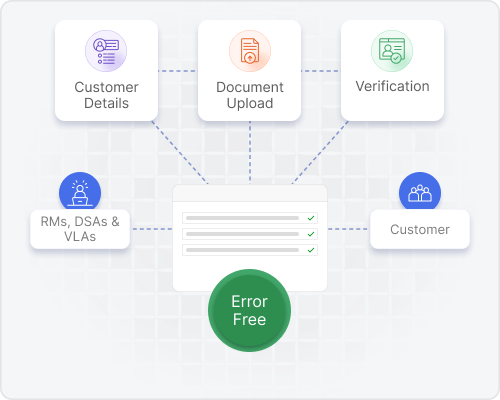

Break down silos across RM, branch, DSA, and digital channels to deliver real-time views of customer value and risk in a single flow

Ensure Smooth Integration

Adapt across products and channels seamlessly, driving compliant, consistent experiences without adding operational burden