Most red flags could be caught early with instant checks- before an offer or interview. Pre-offer screening during peak hiring saves time by filtering out unsuitable candidates upfront.

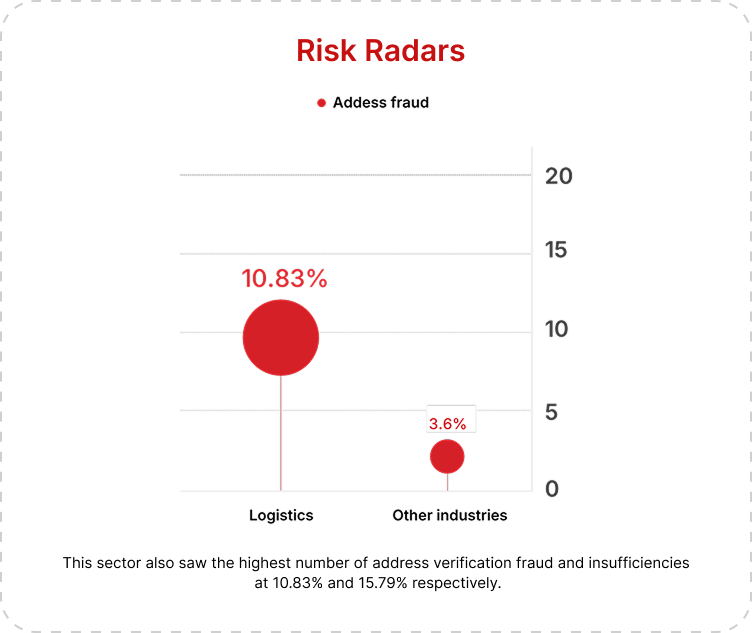

a.k.a. “Risk radars”

We uncovered the hidden risk – the "known unknown" -the employee

fraud companies know exist, but often fail to spot.

Think of it as finding the missing

pieces in your

hiring puzzle.

No fluff – just practical insights to protect your business.

In many cases, companies are equally responsible for fraud as employees. Have you ever wondered what turns an ordinary employee into a fraudster? We have a “Fraud Diamond Theory”1 to substantiate this.

This theory conceptualizes a diamond with four faces-motive, opportunity, capability, and rationalization-the ingredients that must be present for fraud to take place.

In 95% of cases,2 an employee commits fraud due to financial reasons-debt or medical emergencies. Other factors like greed, drugs, and gambling may also play a small role.

Motive alone isn't enough; the employee must also see an opportunity. Fraud occurs when weak processes allow an employee to believe they can avoid punishment.

An existing employee or new recruit with a basic understanding of your company’s internal systems and access is most likely to commit fraud.

When an employee steps over ethical lines, they craft compelling stories to justify their actions. In times of downsizing and job uncertainty, these self-made rationalizations become even more persuasive.

75% of employees have stolen at least once from their employer. 3

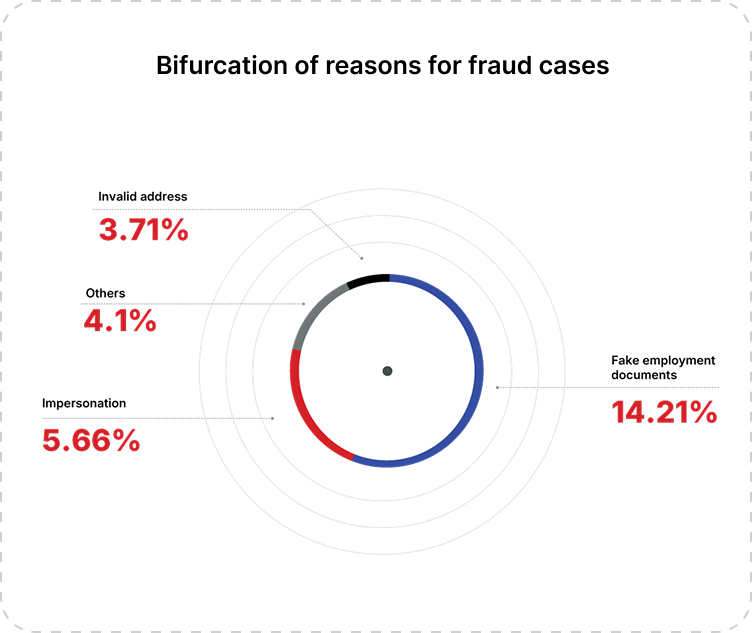

candidates submitting fake documents from blacklisted or non-existent companies.

Recovering costs is often impossible, legal action is expensive, and pursuing a fraudster wastes valuable resources.

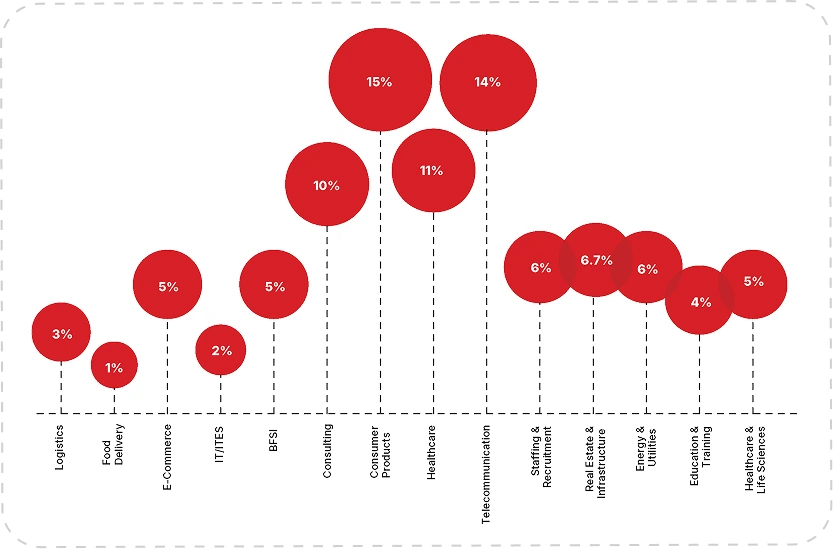

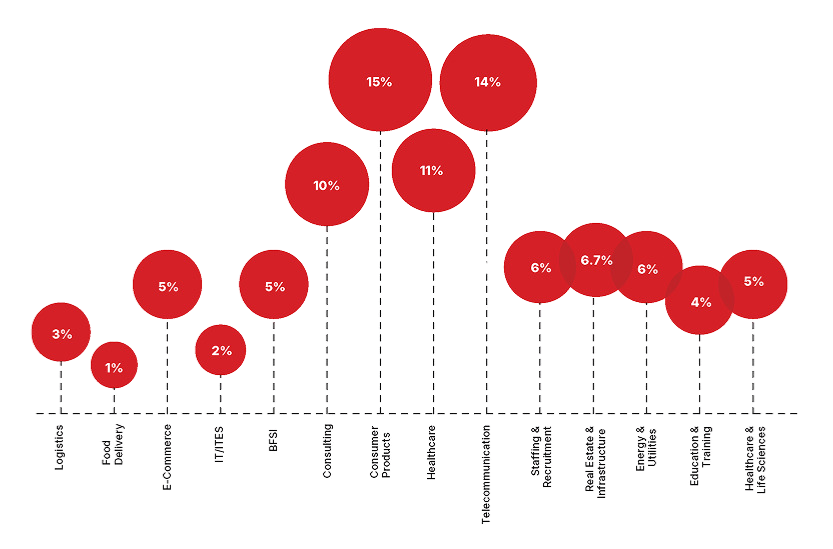

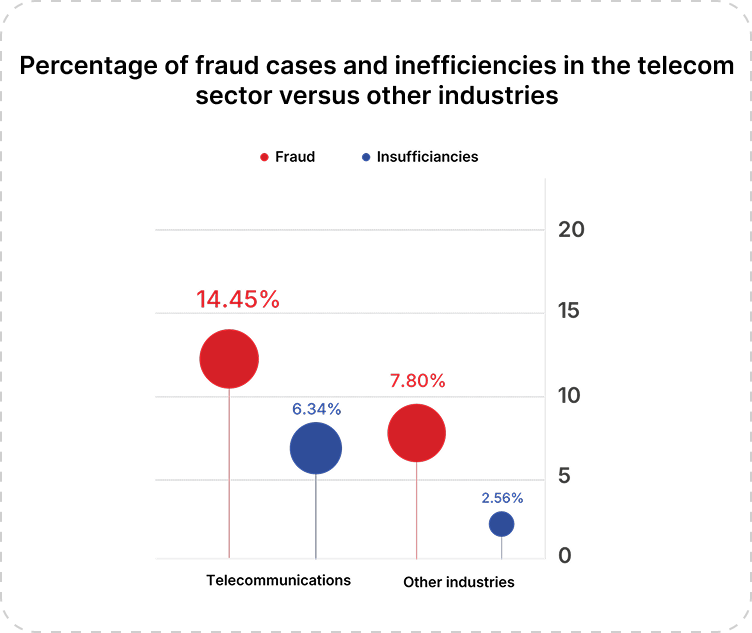

Industry-wise segmentation of fraud

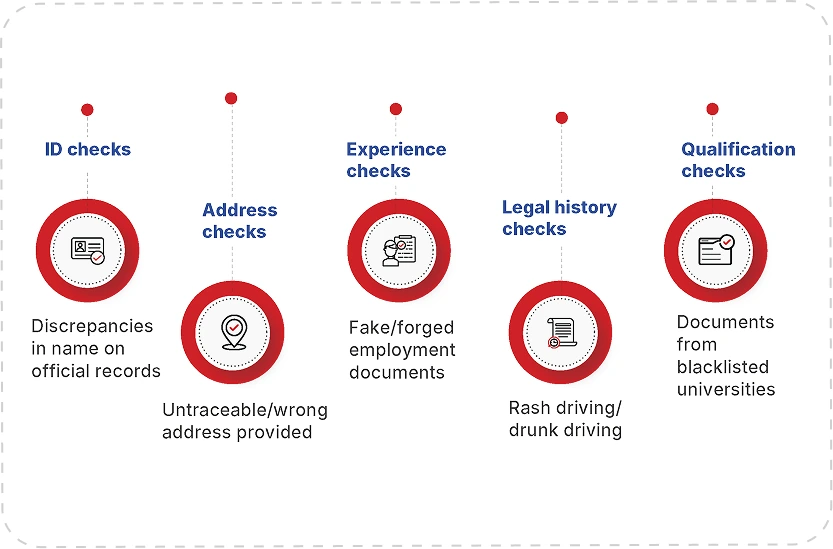

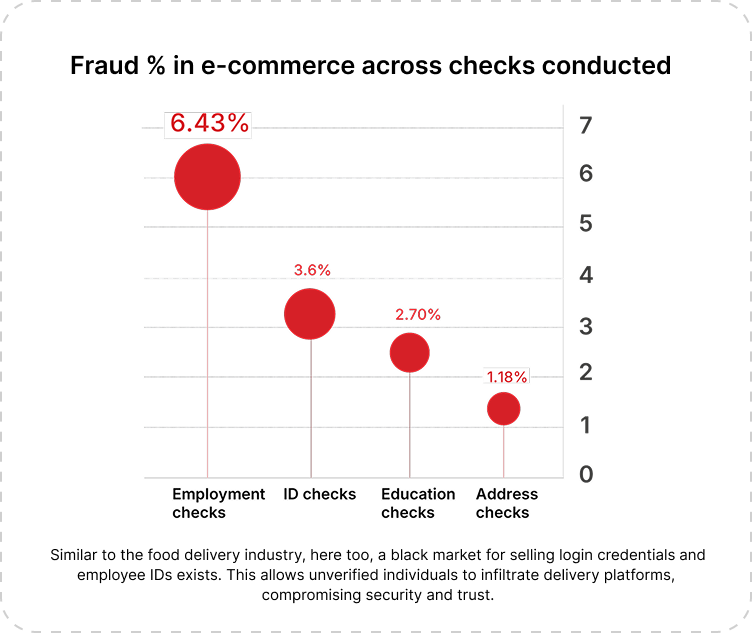

Let’s look at the top reasons for employee fraud in each of the standard checks.

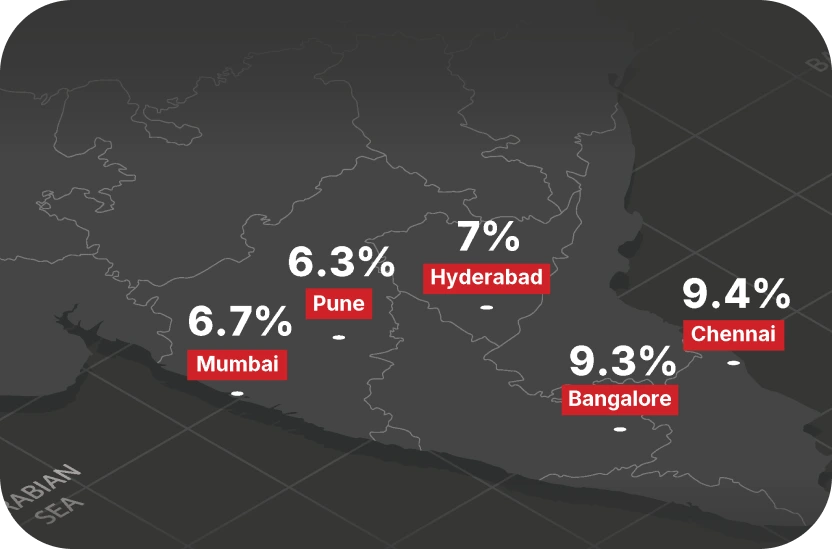

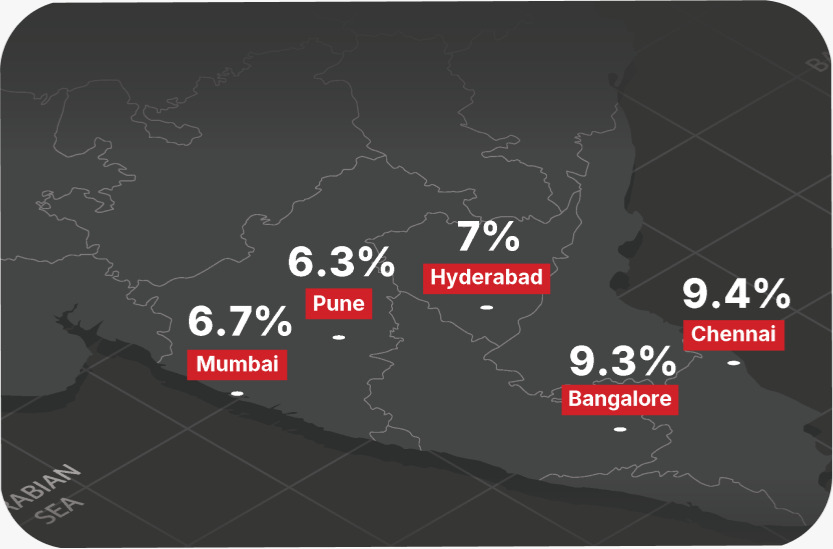

City-wise breakup of instances where fake and forged documents were submitted in both qualification and experience checks

Most red flags could be caught early with instant checks- before an offer or interview. Pre-offer screening during peak hiring saves time by filtering out unsuitable candidates upfront.

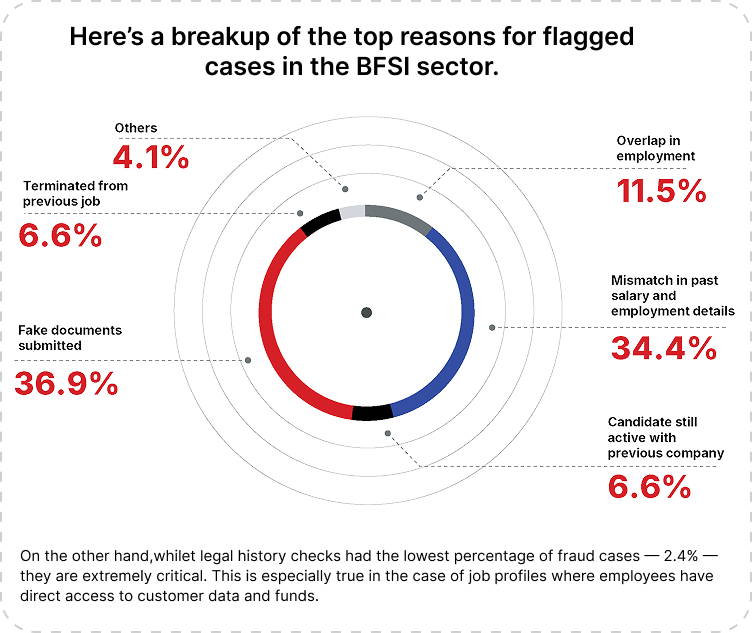

BFSI companies should prioritize criminal verifications and credit history checks. Considering that 33% of fraudsters are repeat offenders, this will also help prevent risk associated with candidates who have been involved in adverse cases.

Senior roles may require additional checks like social media and directorship assessments, especially in public-facing positions

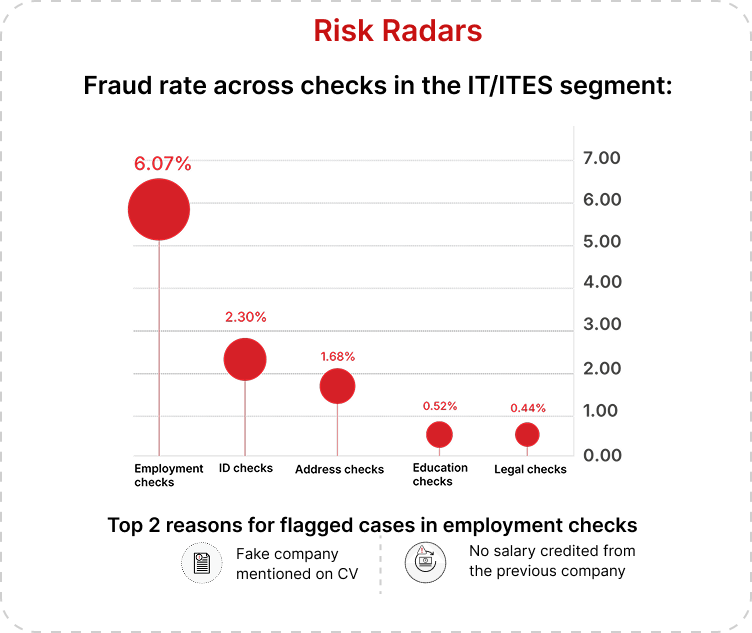

Companies should run a first-level validation during the hiring process to ensure that the companies mentioned on the CV exist. This will also help understand whether the candidates have worked in the mentioned companies or not.

Create a continuous monitoring system for critical roles and security clearances. Consider implementing quarterly re-verification processes for employees handlingsensitive data. Establish clear escalation protocols for red flags and maintain acentralized database of verification results.

To prevent impersonation fraud and scams regarding login credentials, companies should set up a process that requires agents to periodically take selfies to run a face match and check their identity between deliveries, in real-time. This ensures that the same, verified person is making deliveries, thus reducing impersonation fraud, and making the process secure and safe.

In a gig economy, where delivery partners frequently switch platforms, quick verification is critical. Implementing thorough checks that have a rapid turnaround time (TAT) can allow delivery partners to join you the same day they apply. This will make your hiring process quicker and help reduce drop-offs.

Use Employee Provident Fund (EPF) details to instantly verify a candidate's work history before they join. This helps identify and eliminate candidates who have inflated their CV details, saving time and reducing hiring risks.

Nearly 70% of flagged cases involve fake companies or altered details. Pre-screening and pre-interview checks can verify past employment, salary, and company authenticity—catching fraud early without slowing down the hiring process.

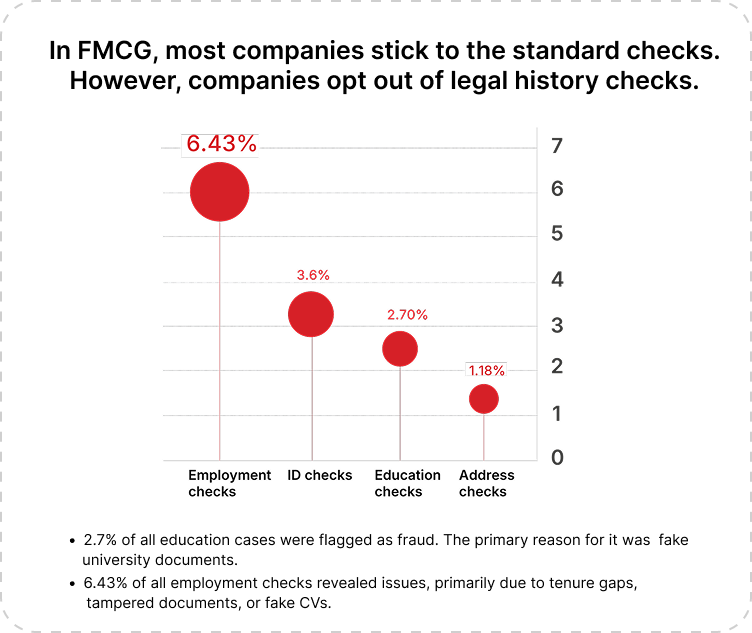

The FMCG sector sees more insufficiencies than others. You can combat them with EPFO-based employment checks and Digilocker for education-faster, smarter resolutions.

Most red flags could be caught early with instant checks-before an offer or interview. Pre-offer screening during peak hiring saves time by filtering out unsuitable candidates upfront.

While identity and address verification ensure the safety of gig workers and delivery staff, and criminal record checks mitigate risks in logistics and cash-on-delivery roles, these checks are rarely enough.

Given the black market for buying and selling employee credentials, companies must implement a continuous monitoring system to verify delivery agents. This system could include a process where agents must periodically take (real-time) selfies between deliveries. This helps ensure the right person is completing deliveries. Thus reducing fraud and enhancing security.

Impersonation and fake documents can be tackled with ID verification and face-match technology. Employers should also verify accrediting universities to prevent fraud.

Salary misrepresentation is rising in healthcare. Payslip verification and PF checks ensure transparency in the screening process.

Insider misuse of sensitive information accounts for 20% of data breaches in this industry. To mitigate such risks, it's crucial to follow all standard verification protocols, with zero tolerance for red flags.

Implementing robust pre-offer checks can further help catch fraudulent candidates before they even join your company.

It is also important to audit each address verification case and opt for digital address verification as it is faster and more transparent. If digital verification doesn't succeed, you can always rely on physical address verification as a backup.

To prevent impersonation fraud and scams regarding login credentials, companies should set up a process that requires agents to periodically take selfies to run a facematch and check their identity between deliveries, in real-time. This ensures that the same, verified person is making deliveries, thus reducing impersonation fraud, and making the process secure and safe.

Despite the rise in employee fraud, firms can fortify themselves with a few key factors.

Once integrated, these measures should be revisited regularly to stay ahead of the ever-evolving fraud landscape.

Why wait for the interview to spot fraud? A detailed, yet instant pre-interview check-covering IDs, PAN, CV, and legal history- can flag unreliable candidates early, nipping employee fraud in the bud.

Integrate your HR tools and platforms to streamline data transfer across the employee lifecycle. This not only saves time and costs but also enhances the employee experience by eliminating repetitive document submissions.

Trust isn't built in isolation—employees face personal and work pressures, and many seek an easy escape. Regular employees may moonlight, get caught in legal issues, or trade secrets to competition. Continuous monitoring helps safeguard sensitive information and prevent fraud.

Companies in the E-commerce, FMCG, and BFSI space can hardly afford to have longwinded due diligence of ground-level employees. These sectors rely heavily on manpower and require quick and friction-free yet highly effective background verifications.

With the DPDPA coming into effect, companies will face increased pressure to comply, while protecting against damages and attacks from harmful agents. Investing in tools that adhere to data privacy rules will minimize the risk of mishandling sensitive information and help prevent privacy violation complaints.

Employees are now more keen to share their lives on social media than ever before. This is a tool that ought to be leveraged to assess if prospective recruits have an iffy track record, an unpalatable past or show a strong tendency towards unprofessional behaviour.

Despite the rise in employee fraud, firms can fortify themselves with a few key factors.

Once integrated, these measures should be revisited regularly to stay ahead of the ever-evolving fraud landscape.

Why wait for the interview to spot fraud? A detailed, yet instant pre-interview check-covering IDs, PAN, CV, and legal history- can flag unreliable candidates early, nipping employee fraud in the bud.

Integrate your HR tools and platforms to streamline data transfer across the employee lifecycle. This not only saves time and costs but also enhances the employee experience by eliminating repetitive document submissions.

Trust isn't built in isolation—employees face personal and work pressures, and many seek an easy escape. Regular employees may moonlight, get caught in legal issues, or trade secrets to competition. Continuous monitoring helps safeguard sensitive information and prevent fraud.

Companies in the E-commerce, FMCG, and BFSI space can hardly afford to have longwinded due diligence of ground-level employees. These sectors rely heavily on manpower and require quick and friction-free yet highly effective background verifications.

With the DPDPA coming into effect, companies will face increased pressure to comply, while protecting against damages and attacks from harmful agents. Investing in tools that adhere to data privacy rules will minimize the risk of mishandling sensitive information and help prevent privacy violation complaints.

Employees are now more keen to share their lives on social media than ever before. This is a tool that ought to be leveraged to assess if prospective recruits have an iffy track record, an unpalatable past or show a strong tendency towards unprofessional behaviour.