Secure Every Claim.

Trust Every Hospital.

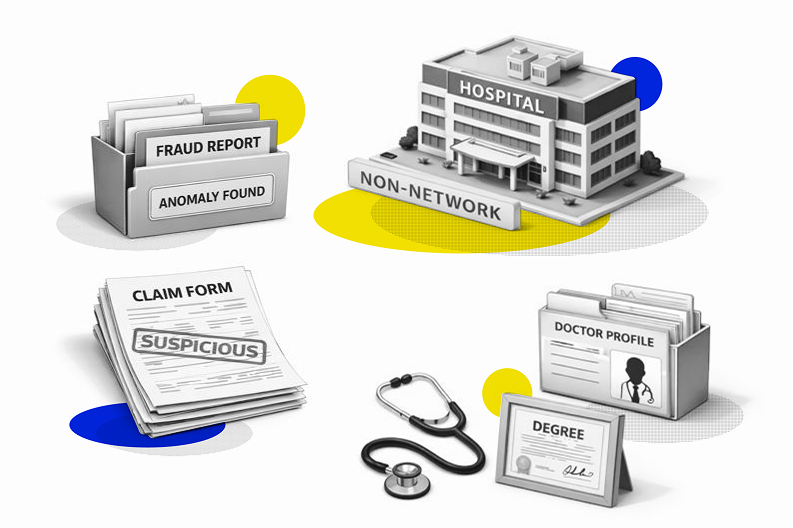

Non-network claims shouldn't be a gamble. We perform in-depth due diligence on hospitals and doctors in real-time, ensuring that every payout goes to a legitimate provider, not a professional fraudster.

Health insurance is shifting The challenges slowing it down

Mis-selling by Agents

Agents often oversell or misrepresent insurance policies to meet targets, leading to high claim ratios and poor customer retention.

Long & Complex Sales Cycles

Customers drop off due to repeated follow-ups, unclear product value, and lengthy decision-making cycles.

Fraudulent Claims from Non-Network Hospitals

Insurers face major losses due to fraudulent claims filed through unverified hospitals.

Why Leading Consumer Brands Choose IDfy

Because growth without trust is just risk at scale.

- Perform due diligence on non-network hospitals, checking financial stability, accreditation, and infrastructure.

- Ensure the doctors signing off on claims are legitimate and qualified.

- Identify and block fraudulent claims before they impact your bottom line.

Your Out-of-Network Claims Are a Ticking Time Bomb.

In a recent check for a leading national insurer, we flagged 8% of non-network hospitals as high-risk.

This Isn’t random. It’s a pattern.

Organized Fraud

We found active legal cases against hospitals and their promoters for systematic cheating and bill inflation.

Reputation Laundering

Hospitals were making claims far beyond their official accreditation, exposing you to massive reputational risk.

Financial Mismatches

We uncovered significant discrepancies between a hospital’s declared income and the value of claims being filed.

Three Platforms.

One Seamless Solution.

Enabling Trust

Trust that Delivers

The Technology That Powers India's Leading Insurers