Frequently Searched

IDfy’s Legal History Checks

Reduce your NPA risks by assessing a borrower’s legal history

IDfy helps you make more informed lending decisions by assessing your client’s (individual/entity) legal history and its impact on their loan repayment capacity.

We use our pan-India records of court cases, tribunal cases, and FIRs to give you a holistic view of your borrower’s legal background. IDfy’s risk report is easy to understand and provides an overall risk score based on the subject’s legal standing.

How legal history checks help you reduce your NPAs

with past criminal offenses indulge in crime again

The likelihood of an individual/company defaulting on your payment is strongly related to the severity & implications of their legal history.

4 Reasons why you need IDfy’s Legal History Checks

Pan-Indian

Coverage

Draws results using a database of 24+ Crore court cases & 5+ Crore FIRs

Fuzzy

Logic

Identifies closely related matches to uncover all about a party’s legal background

Actionable Risk

Score

Gives an actionable risk score based on the number and the severity of the court cases found

Risk analysis by the legal experts

Our legal team provides you with a detailed risk report that includes the case summaries and their implications

The best in business trust us

Solutions we offer

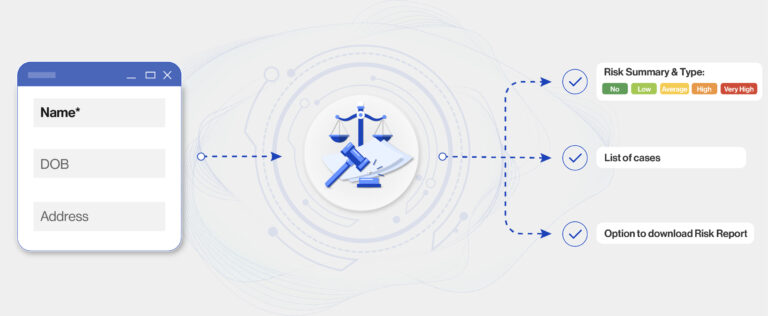

Case Search

Instantly find court records/FIRs against an individual/company using our Pan-India database

Crime Report

Get a risk report consisting of the case summary & its implications curated by our legal/paralegal teams within 24 hours of raising the request

Crime Watch

Keep a regular check your client’s legal background and get notified when a new case shows up against their name

How it works

Video KYC

Video KYC