Here are 10 things you definitely need to know to keep yourself compliant with the new regulations.

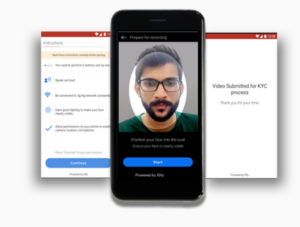

The wait is over. The day is here. India has entered the new world of remote customer onboarding using video.

Video KYC, for short!

With the RBI’s latest amendment to the Master Direction of KYC, Banks and Financial Institutions in India can conduct their customers’ KYC over video.

Here are 10 things you definitely need to know to keep yourself compliant with the new KYC regulations.

- The customer’s picture should be live and not a photo-of-a-photo

- You’ll need a clear PAN card image and verify PAN credentials from the Government database

- You’ll need to do a Face Match between the customer’s photo and those on the IDs (PAN / Aadhaar) to ensure both are of the same person

- Live location of the customer needs to be geo-tagged to ensure they are in India

- The Video interaction should be triggered from the Regulated Entity’s domain, so Google Duo or FaceTime can’t be used

- The video recording should be stored in a safe and secure manner, with a date and time stamp

- Aadhaar Offline verification (Aadhaar XML) should not be more than 3 days old

- The Aadhaar number should be masked (concealed/redacted)

- The session requires both the user and an employee of the Regulated Entity to be present simultaneously

- Prior consent of the customer needs to be explicitly taken before launching the KYC process

To schedule a demo with IDfy, please email shivani@idfy.com or fill out the form here.

Video KYC

Video KYC