Regulations have made the term “Know Your Customer” (KYC) a commonplace. All institutions in the BFSI industry are required to adhere to KYC regulations. Hence, KYC must be done whenever a consumer requests financial services. This still applies even if the customer has completed their Know Your Customer (KYC) with another company already.

This customary KYC compliance is a hardship on both customers and businesses. CKYC act was issued to minimize the burden of several KYC transactions while reducing financial crime.

What is Central KYC?

One KYC for individuals

Central Know Your Customer, also known as CKYC, is an initiative by the Indian government. Its main objective is to standardize the Know Your Customer (KYC) process across all financial institutions. CERSAI (Central Registry of Securitisation and Asset Reconstruction) oversees the CKYC Registry.

CKYCR attempts to reduce the burden of KYC document production and eliminate redundancy in KYC compliance. It serves as a central repository for all the personal information of any customer.

The Indian Finance Ministry issued the CKYC directive in the 2012-13 Union Budget. Thereafter, it became functional in July 2016.

Features of CKYC

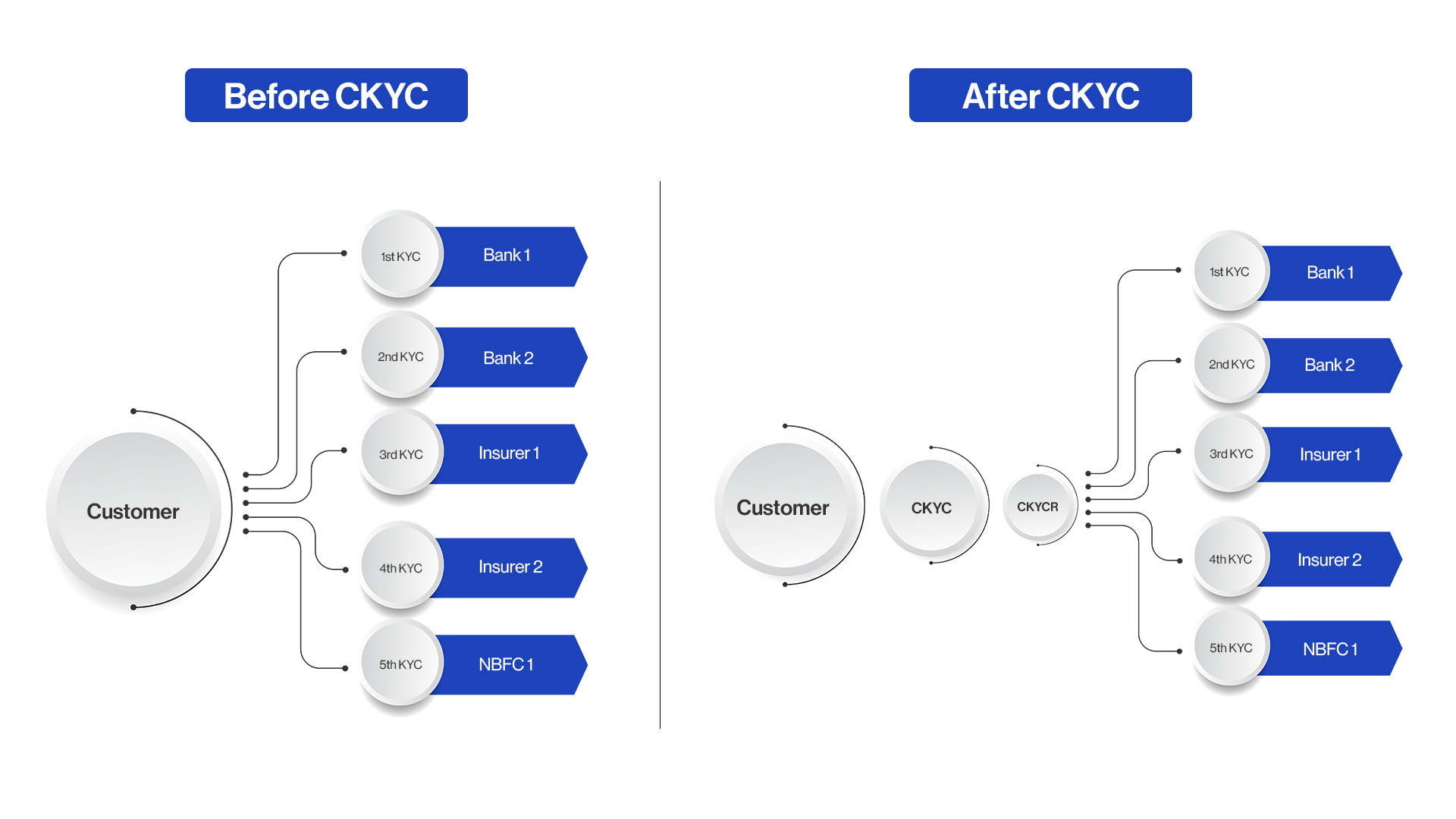

Before CKYC was introduced, availing any financial service was a hassle. The banking institution’s requirements necessitated a flurry of paperwork, demanding both time and effort. To illustrate, to open an account at a new financial institution, one had to undergo the same tedious documentation process all over again.

However, thanks to CKYC, this burden has been significantly reduced. Now, paperwork for customers is virtually eliminated, as their data is stored in a central location. Moreover, this data is readily accessible to authorized financial institutions. Consequently, both customers and banking institutions benefit from this streamlined process.

CKYC has multiple features that make it a valuable tool for ensuring compliance:

- Each customer’s KYC data is associated with a unique identifier – the KYC Identification Number (KIN).

- The data is carefully saved in digital form in a centralized repository.

- FIs can obtain KYC records in bulk by simply entering the CKYC identifier and then authenticating to gain access to the documents.

- When a customer’s KYC records are updated, the relevant organizations are alerted.

- Customers have the option of linking their KYC to multiple correspondence addresses.

How does CKYC work?

Prior to availing a financial service in India, the government has made it mandatory to complete KYC. Financial services can be obtained by completing the CKYC only once.

Step-by-Step CKYC Process:

- Form Submission: Customers fill out a KYC form before investing with a fund company, which is then forwarded to CERSAI for verification.

- Verification by CERSAI: CERSAI confirms adherence to CKYC guidelines and securely stores the KYC documents on a server.

- Issuance of KIN: Customers who complete CKYC receive a 14-digit KYC Identification Number (KIN) via SMS and email, linking their ID proof to this number.

- Simplified KYC with KIN: Users can present their KIN to any financial institution to fulfill KYC requirements without resubmitting documents.

- Document Access Through KIN: Businesses can retrieve a customer’s documents from CERSAI using the CKYC number for KYC verification.

This simplifies the KYC verification procedure for all parties involved.

Here’s a comparison of KYC verification before and after the implementation of CKYC.

CKYC eliminates the need for repeated KYC transactions by allowing FIs to validate a customer’s KYC based solely on their KIN, as demonstrated above.

How is it different from KYC and eKYC?

Three concepts that appear to be identical are actually distinct: CKYC, KYC, and eKYC.

KYC

As a matter of policy, all financial institutions are required to conduct a Know Your Customer (KYC) process. It is used to identify, investigate, and monitor potential cases of financial fraud. Several paper-based, digital, and video-based KYC methods are available under KYC.

eKYC

Customers’ identities are verified digitally through the use of a process known as ‘Electronic KYC’ or eKYC. The UIDAI database aids in eKYC identification verification. This is possible after the customer confirms the eKYC request which they receive via OTP, offline via XML files, or through the QR code on their Aadhaar card.

CKYC

As stated previously, CKYC is done to assist investors conduct their KYC only once. Any RBI, IRDA, SEBI, or PFRDA registered company does not require the investor to complete repetitive KYC procedures. It facilitates investment participation and easy client onboarding.

Benefits of CKYC

CKYC, a one-time process has multiple benefits. It’s got it all: time savings, ease of use, and universal accessibility.

Efficient Account Setup: Signing up is straightforward, allowing easy access for investors to manage their investment data.

Cost Savings for Financial Institutions: A centralized KYC database means only one institution needs to perform KYC per customer, reducing costs and freeing resources for other business areas in the BFSI sector.

User-Friendly KYC Process: CKYC eliminates the need for clients to repeatedly provide KYC documents, streamlining financial transactions.

Reduced KYC Time and Effort: Once registered with CKYC, individuals and FIs save time by avoiding repetitive paperwork and separate KYC verifications.

Enhanced Security: It standardizes identification, protecting against fraud and money laundering.

To know more about KYC, read our extensive blog on ‘All you need to know about KYC in India‘.

Video KYC

Video KYC